Benefit from a wide range of long and short-term investment strategies tailored to meet your goals.

Arrange to have First Bank perform any number of special services for you and your beneficiaries, now or in the future.

Maximize your retirement options when you roll your accounts over to First Bank and choose a fully-managed or self-directed IRA.

Rest easy knowing we will take care of your estate - from probate of your Will to the final settlement.

Alan

Spears

Sr. Vice President

Sr. Trust Officer

Don

Hawk

Vice President

Sr. Trust Officer

Lisa

Savage

Admin Assistant

Kim

Northington

Admin Assistant

Cami

Gomez

Clerical

If you're looking for professional investment management and advice, our trust officer will work with you to create a customized portfolio based on your life stage and investment goals.

If you would rather not tackle the clerical and accounting work that comes with self-directed investing, First Bank can help. From calculating projections to settling trades, you'll have the peace of mind that comes with having custody of your assets in one secure place.

Established while you are living, we will manage your assets for you during your lifetime. At your death these assets pass to your beneficiaries without the delays, expenses and publicity of probate.

If you are planning to use life insurance as wealth replacement, this trust provides liquidity to pay estate tax and settlement costs, as well as financial support for family members.

As part of your Will, this trust ensures that your wishes with regard to your assets are fulfilled long-term. We will invest your assets to provide continuing income for your beneficiaries after your death.

If you are interested in contributing your assets to a charitable organization, our services include development of written guidelines, administration of the trust and any endowment, as well as record-keeping, reporting and distributions from the trust.

For businesses wanting to provide a defined contribution plan for their employees. This type of plan allows employees to set aside tax-deferred income for retirement purposes.

We will design and manage your plan, educate your employees, and provide regular reports. You’ll have a wide variety of investment options, a local contact at First Bank, and online access to view your portfolio and make changes.

Did you receive a lump-sum distribution from a pension or profit-sharing plan, or do you have substantial IRA accounts elsewhere? We have two IRA options to consolidate and maximize your money.

Fully-managed IRA – You set the goals, we build and manage your portfolio.

Self-directed IRA – We act as trustee, you make all the decisions.

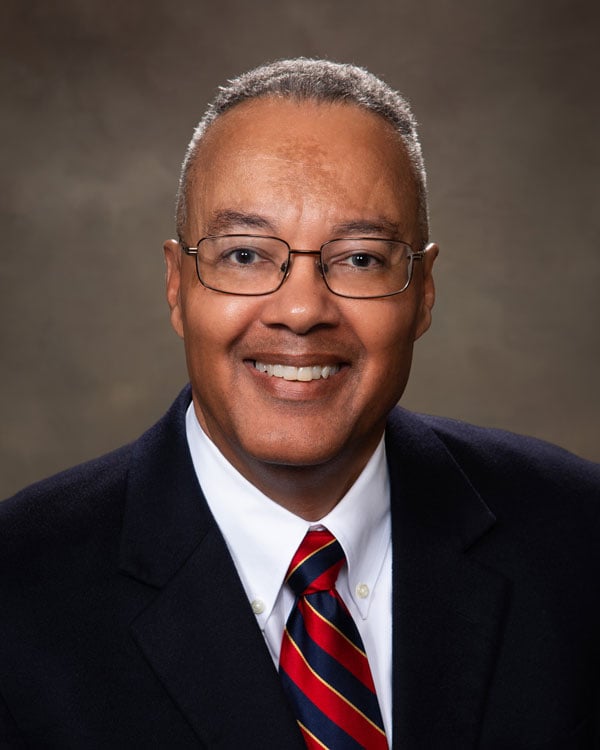

Senior Vice President

Chief Wealth Management Officer

A native of Richmond with over 30 years of experience, Alan formed the Trust and Investment Services Department at First Bank Richmond in 2003. He earned his Bachelor's, Master's, and law degrees from Indiana University. He also volunteers his time to multiple non-profit organizations in the community.

Vice President

Senior Trust Officer

Don joined the Wealth Management Department at First Bank Richmond in 2022, bringing expertise in financial planning, wealth management, and trust & estate administration from nearly 15 years in the financial services industry and 7 years in the private practice of law.

Lisa

Savage

Admin Assistant

Kim

Northington

Admin Assistant

Most importantly, it shows you care about their future. These types of benefits are especially important to millennials. Most companies already provide a 401(k) benefit, so you’ll be competing with these companies for good talent. Research shows that employees tend to stay longer if their company offers retirement benefits. And it will save you money on your taxes. You can deduct your employer contribution to your team’s 401(k). For small businesses with less than 100 employees, there is an additional credit for the first three years to offset the cost of administration fees.

Yes, this is known as a trustee-to-trustee 401k rollover. All you have to do is request the distribution 401k rollover forms from your old employer. Once your former employer has given them to you then you can transfer your 401k to an IRA. There are no penalties for a trustee-to-trustee transfer. If the former employee sends the funds to you directly then there will be a deduction and 20% will be remitted to the IRS.

INVESTMENT PRODUCTS/SERVICES ARE:

NOT A DEPOSIT - NOT FDIC INSURED - NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

NOT GUARANTEED BY THE BANK - MAY LOSE VALUE